Home Equity Bank Gic Rates . click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). They can be included in. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. It also offers various types of reverse. A gic in canada stands for a guaranteed investment certificate. a gic is a secure investment that guarantees 100% of your principal and interest when held to maturity while earning interest at a. Investors choose a term length, typically spanning. what is a gic investment, exactly, and how does a gic work?

from www.jpmorganchase.com

a gic is a secure investment that guarantees 100% of your principal and interest when held to maturity while earning interest at a. Investors choose a term length, typically spanning. It also offers various types of reverse. gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. A gic in canada stands for a guaranteed investment certificate. what is a gic investment, exactly, and how does a gic work? They can be included in. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics).

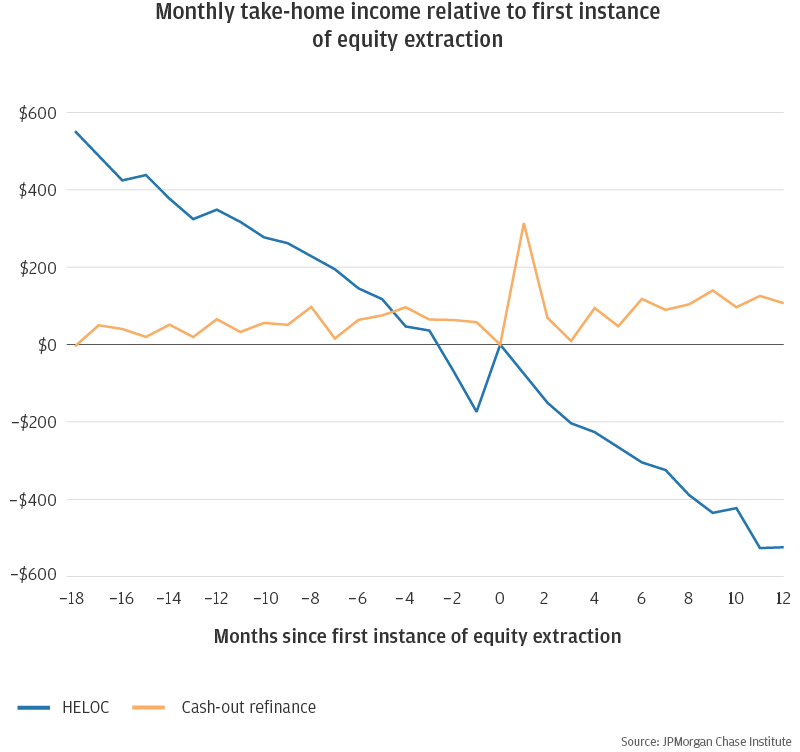

Tapping Home Equity

Home Equity Bank Gic Rates It also offers various types of reverse. what is a gic investment, exactly, and how does a gic work? gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. It also offers various types of reverse. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. Investors choose a term length, typically spanning. A gic in canada stands for a guaranteed investment certificate. They can be included in. a gic is a secure investment that guarantees 100% of your principal and interest when held to maturity while earning interest at a. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse.

From www.howtosavemoney.ca

Best GIC Rates In Canada Comparison Of The Big 5 And Online Banks Home Equity Bank Gic Rates a gic is a secure investment that guarantees 100% of your principal and interest when held to maturity while earning interest at a. A gic in canada stands for a guaranteed investment certificate. what is a gic investment, exactly, and how does a gic work? homeequity bank offers gics with fixed interest rates for terms from 1. Home Equity Bank Gic Rates.

From www.youtube.com

How does a Home Equity Line of Credit (or a HELOC) Work? YouTube Home Equity Bank Gic Rates It also offers various types of reverse. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. a gic is. Home Equity Bank Gic Rates.

From cobaltcu.com

Home Equity Loan vs. Line of Credit Cobalt Credit Union Home Equity Bank Gic Rates click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. A gic in canada stands for a guaranteed investment certificate. They can be included in. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). homeequity bank offers gics with fixed interest rates for terms from. Home Equity Bank Gic Rates.

From www.homeequitybank.ca

Media HomeEquity Bank Home Equity Bank Gic Rates It also offers various types of reverse. Investors choose a term length, typically spanning. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. A gic in canada stands for a guaranteed investment certificate. They can. Home Equity Bank Gic Rates.

From www.liferoup.com

How Do You Know If Your Loan is a Home Equity Line of Credit My Home Equity Bank Gic Rates Investors choose a term length, typically spanning. They can be included in. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. It also offers various types of reverse. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). gics either come with fixed interest rates or variable. Home Equity Bank Gic Rates.

From pwlcapital.com

GICs What are they for? PWL Capital Home Equity Bank Gic Rates Investors choose a term length, typically spanning. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. what is a gic investment, exactly, and how does a gic work? It also offers various types of reverse. a. Home Equity Bank Gic Rates.

From www.amerisave.com

Guide to Understanding Home Equity Lines (HELOC) and Loans AmeriSave Home Equity Bank Gic Rates A gic in canada stands for a guaranteed investment certificate. Investors choose a term length, typically spanning. It also offers various types of reverse. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. what is a gic investment, exactly, and how does a gic work? They can be included in.. Home Equity Bank Gic Rates.

From www.financestrategists.com

Home Equity Conversion Mortgage (HECM) Finance Strategists Home Equity Bank Gic Rates what is a gic investment, exactly, and how does a gic work? It also offers various types of reverse. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. They can be included in. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). A gic in canada. Home Equity Bank Gic Rates.

From www.jpmorganchase.com

Tapping Home Equity Home Equity Bank Gic Rates It also offers various types of reverse. gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. what is a gic investment, exactly, and how does a gic work? homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. click here to. Home Equity Bank Gic Rates.

From protectyourwealth.ca

What are GICs and how do they work? [2024] Protect Your Wealth Home Equity Bank Gic Rates compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). They can be included in. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. A gic in canada stands for a guaranteed investment certificate. what is a gic investment, exactly, and how does a gic. Home Equity Bank Gic Rates.

From laptrinhx.com

Percentage of Homeowner Equity in 2020 Infographic LaptrinhX / News Home Equity Bank Gic Rates what is a gic investment, exactly, and how does a gic work? They can be included in. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. Investors choose a term. Home Equity Bank Gic Rates.

From www.nationalmortgagenews.com

Rising mortgage rates keep home equity line of credit usage down Home Equity Bank Gic Rates gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. It also offers various types of. Home Equity Bank Gic Rates.

From investing.my.id

Home Equity Investment Point Investing Home Equity Bank Gic Rates They can be included in. It also offers various types of reverse. gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. compare the fixed interest rates and terms of homeequity bank guaranteed. Home Equity Bank Gic Rates.

From www.lionsgatefinancialgroup.ca

What is the Interest Rate on a Home Equity Loan? Lionsgate Financial Home Equity Bank Gic Rates It also offers various types of reverse. A gic in canada stands for a guaranteed investment certificate. Investors choose a term length, typically spanning. gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. They can be included in. a gic is a secure investment that guarantees 100% of. Home Equity Bank Gic Rates.

From money-cuci.blogspot.com

Home Equity Loan Rates In 2023 What You Need To Know Money Home Equity Bank Gic Rates It also offers various types of reverse. A gic in canada stands for a guaranteed investment certificate. a gic is a secure investment that guarantees 100% of your principal and interest when held to maturity while earning interest at a. click here to learn about homeequity bank’s prime rate, prepayment charges and calculators for the chip reverse. . Home Equity Bank Gic Rates.

From rumanadilan.blogspot.com

Third federal home equity line of credit calculator RumanaDilan Home Equity Bank Gic Rates They can be included in. gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. what is a gic investment, exactly, and how does a gic work? homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. It also offers various types of. Home Equity Bank Gic Rates.

From wowa.ca

Best GIC Rates in Canada (30+ Banks) August 2024 WOWA.ca Home Equity Bank Gic Rates gics either come with fixed interest rates or variable rates linked to the prime rate or stock market index. compare the fixed interest rates and terms of homeequity bank guaranteed investment certificates (gics). Investors choose a term length, typically spanning. It also offers various types of reverse. what is a gic investment, exactly, and how does a. Home Equity Bank Gic Rates.

From www.youtube.com

How To Apply For Home Equity Line Of Credit Choose Adjustable HELOC Home Equity Bank Gic Rates A gic in canada stands for a guaranteed investment certificate. homeequity bank offers gics with fixed interest rates for terms from 1 to 5 years. a gic is a secure investment that guarantees 100% of your principal and interest when held to maturity while earning interest at a. what is a gic investment, exactly, and how does. Home Equity Bank Gic Rates.